Cost Rental Ireland is transforming affordable housing. As the country’s fastest-growing tenure type, Cost Rental offers middle-income households rents at least 25% below market rates – but for Approved Housing Bodies (AHBs) and Local Authorities, managing these properties presents unique operational challenges.

With the Government targeting 18,000 Cost Rental homes by 2030 under Housing for All, the question isn’t whether Cost Rental Ireland will expand. It’s whether housing providers have the right property management software in place.

📑 Table of Contents

🏠 What is Cost Rental Housing in Ireland?

Cost Rental Ireland isn’t just another housing scheme. It’s fundamentally different from traditional social housing in how rents are calculated, how tenancies work, and how eligibility is assessed.

Established under the Affordable Housing Act 2021, Cost Rental is a tenure where rents are based on the actual cost of building, managing, and maintaining the property over a 40-year period – not market rates. According to Citizens Information, this typically means rents at least 25% below comparable private rentals.

💰 Example Savings in Dublin

€1,350 vs €1,800+

Two-bed apartment monthly rent comparison

Save over €5,400 per year

✅ Cost Rental Ireland Eligibility Criteria

To qualify for Cost Rental Ireland housing, applicants must meet specific criteria that require careful verification by housing providers:

📍 Income Limits

- 🏙️ Dublin: Below €66,000 net

- 🌍 Elsewhere: Below €59,000 net

- 📊 Affordability: Rent ≤35% of income

📋 Other Requirements

- 🏠 No existing property ownership

- ❌ Not receiving HAP/Rent Supplement

- 👨👩👧 Household size matching property

🔒 Security of Tenure: Tenants get long-term security – they can stay indefinitely after six months of continuous occupation. Rent increases are linked to inflation rather than market conditions, making household budgeting predictable.

⚠️ The 5 Biggest Cost Rental Ireland Management Challenges

Managing Cost Rental Ireland properties requires a fundamentally different operational approach than traditional social housing. Here are the top 5 challenges AHBs and Local Authorities face:

📬

1. High Application Volumes

40x

more applications than available units

📄

2. Complex Income Verification

Processing bank statements, P60s, employment letters, and social welfare documentation

📋

4. RTB Compliance

All Cost Rental tenancies must be registered with the Residential Tenancies Board (RTB), with specific rent-setting documentation

📈

5. Inflation-Linked Rent Reviews

Annual reviews must track inflation – requiring automated calculation and audit trails

💡 5 Ways Rentalize Solves Cost Rental Ireland Challenges

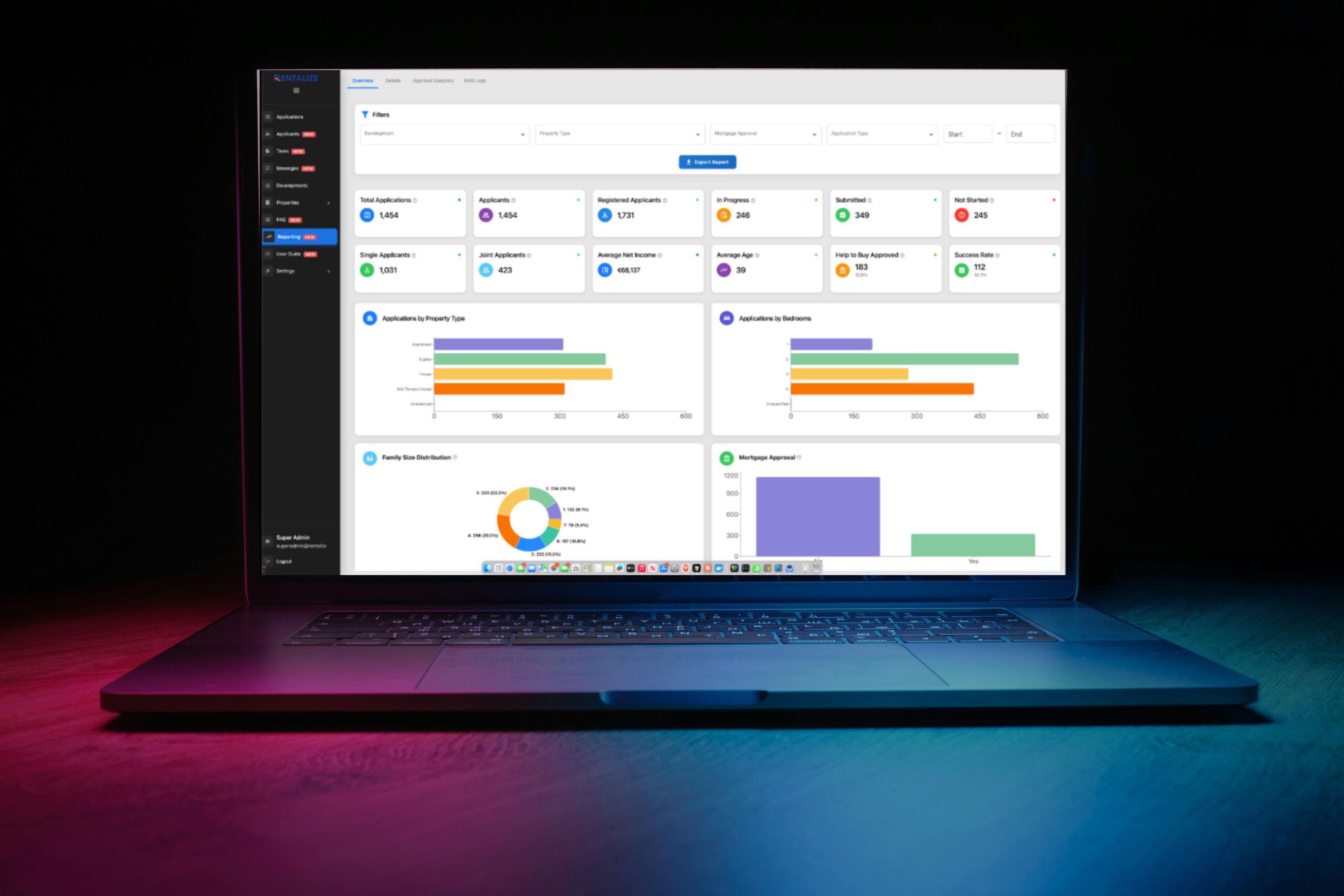

Rentalize was built specifically for the Irish affordable housing sector. Here’s how we help AHBs and Local Authorities manage Cost Rental Ireland efficiently:

1️⃣ Automated Applicant Processing

When you’re receiving thousands of expressions of interest, you need systems that handle volume without sacrificing accuracy. Rentalize automates income verification against Cost Rental Ireland thresholds, validates eligibility criteria, and manages documentation requirements.

2️⃣ AI-Powered Document Processing

Every Cost Rental application involves bank statements, employment letters, P60s, and proof of identity. Our AI-powered document processing (built on AWS Bedrock with full GDPR compliance) extracts relevant information and flags inconsistencies automatically.

Learn more about how AI and automation transforms housing management.

3️⃣ Compliance-Ready Platform

The Affordable Housing Act 2021 sets specific requirements for Cost Rental Ireland. Our platform is designed around Irish regulatory requirements – RTB integration, rent-setting methodologies, and audit trails included.

Discover our property management features for Irish compliance.

4️⃣ Automated Rent Reviews

Cost Rental Ireland rents must track inflation. Rentalize automatically calculates review dates, applies inflation adjustments, generates tenant notifications, and maintains audit trails for regulatory oversight.

5️⃣ Mixed-Tenure Portfolio Management

Most housing providers juggle social housing, HAP tenancies, and Cost Rental Ireland within the same portfolio. Rentalize handles this complexity without duplicate data entry or artificial separations.

🇮🇪 Why Choose Irish-Built Property Management Software?

Generic property management software wasn’t designed for Irish affordable housing. It doesn’t understand differential rent schemes. It doesn’t integrate with the RTB. It doesn’t know the difference between HAP and RAS.

Rentalize does. We’re already working with Irish Local Authorities managing substantial property portfolios, and we’re scaling through the OGP framework to support more housing providers as Cost Rental Ireland expands.

Read how we’re helping Local Authorities transform their operations.

🏛️

RTB Integration

Built-in compliance

📊

Irish Regulations

HAP, RAS & Cost Rental

🏢

OGP Framework

Government approved

🚀 The Future of Cost Rental Ireland

Cost Rental Ireland isn’t a pilot programme anymore. With major providers like Clúid, Tuath, Respond, and Circle actively expanding portfolios, and Local Authorities like Fingal bringing schemes online, the sector is scaling rapidly.

The Housing Agency continues supporting delivery through CREL funding, and the Land Development Agency (LDA) is developing its own substantial pipeline.

🎯 Housing for All Target

18,000

Cost Rental homes by 2030

For housing providers, the question is straightforward: can your current systems handle what’s coming?

❓ Frequently Asked Questions About Cost Rental Ireland

💻 What software do AHBs use to manage Cost Rental Ireland properties?

AHBs across Ireland use various property management systems, but many find generic software doesn’t meet Affordable Housing Act 2021 requirements. Purpose-built solutions like Rentalize offer compliance-ready features for income verification, rent reviews, and RTB integration.

🏠 How is Cost Rental Ireland different from social housing?

Cost Rental Ireland targets middle-income households (net income below €66,000 in Dublin, €59,000 elsewhere) who don’t qualify for social housing but struggle with market rents. Rents are set based on provision cost over 40 years and must be at least 25% below market rates.

💰 What are the income limits for Cost Rental Ireland?

Net household income must be below €66,000 per annum in Dublin and €59,000 elsewhere in Ireland. Additionally, rent cannot exceed 35% of your net household income.

🏗️ How many Cost Rental homes will be built in Ireland?

The Government’s Housing for All plan targets 18,000 Cost Rental Ireland homes by 2030. Major AHBs like Clúid already manage over 1,000 Cost Rental properties, with hundreds more delivered annually.

🚀 Get Started with Cost Rental Ireland Software

If you’re an AHB or Local Authority exploring Cost Rental Ireland – or already managing a portfolio and looking to improve efficiency – we’d be happy to show you how Rentalize approaches these challenges.

No generic demos. No features you’ll never use. Just a focused conversation about what Irish affordable housing providers actually need.